Vanguard annuity calculator

SAVINGS AND CD RATES. If youre in the market for an online broker read our reviews to help determine which brokerage account is for you.

Keep Your Annuity Costs In Check Kiplinger

Investment calculators tools.

. Compare Instant FREE QLAC Quotes. Further the company offers securities brokerage and investment services. QLAC Qualifying Longevity Annuity Contract allow to shield 145000 in IRA dollar from RMDs.

Vanguard published a great article about these types of. This dca calculator stock strengths your financial strategy. How much should I be saving.

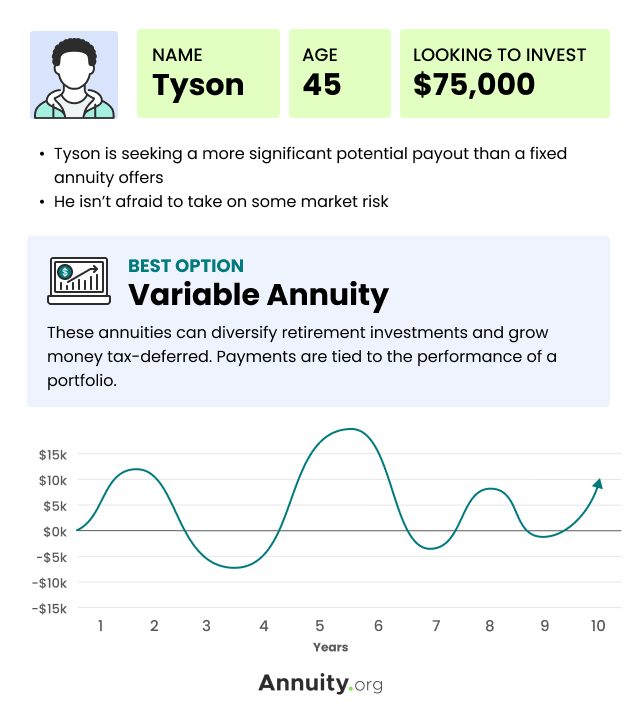

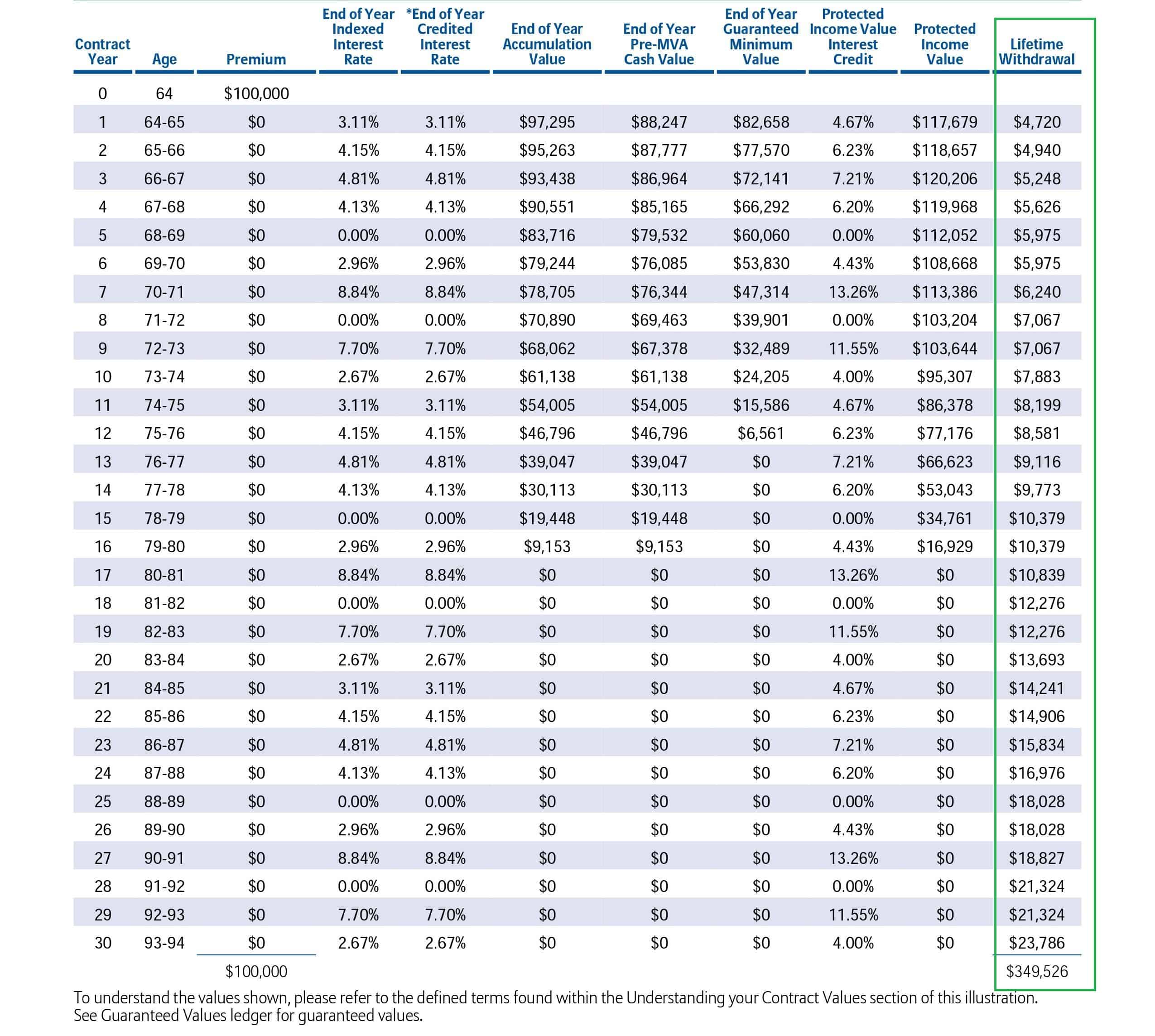

The Vanguard Personal Pension is a flexible and tax-efficient way to save for your retirement. A variable annuity invests your money in certain types funds a fixed annuity grows via a set interest rate and an indexed annuity earns returns based on the. The Vanguard Variable Annuity offers consumers a variety of investment portfolios to choose from with many perks like transfers from checking and savings accounts the ability to move money between portfolios two income options to choose from two death benefits no surrender.

All investing is subject to risk including the possible loss of the money you invest. After that you need to find out the vanguard funds that are quite identical to other fund families. Diversification does not ensure a profit or protect against a loss.

Mutual fund companies like Vanguard and T. Vanguard and Morningstar Inc as of December 31 2021. Large banks such as Bank of America.

Here are the best companies based on expertise security fees and more. Low rates means they can seem bad value. Read Ally Invest Review.

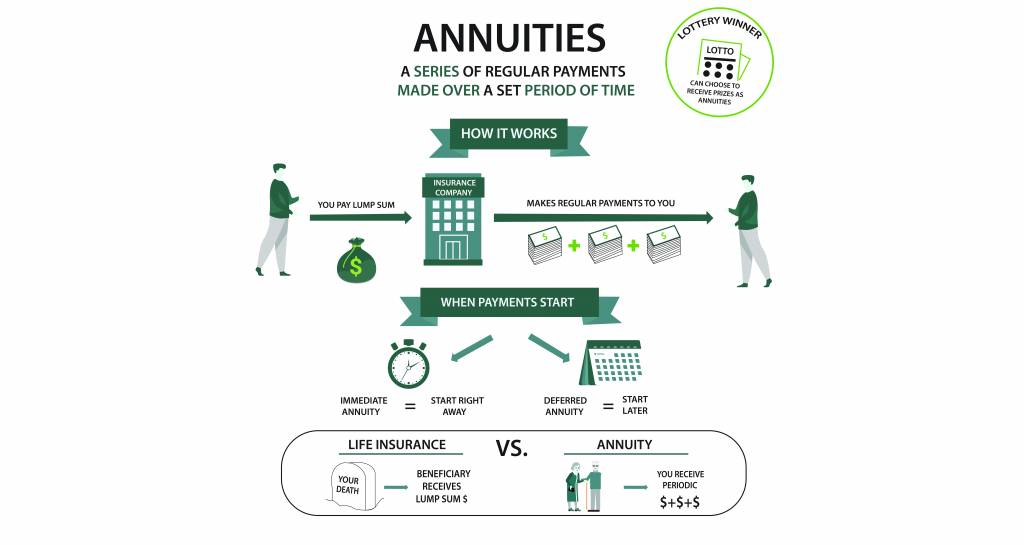

You pay for the annuity through a lump sum or multiple payments and the company uses a strategy to grow your assets. Then compare your investments with market values. Select up to five mutual funds or ETFs to compare.

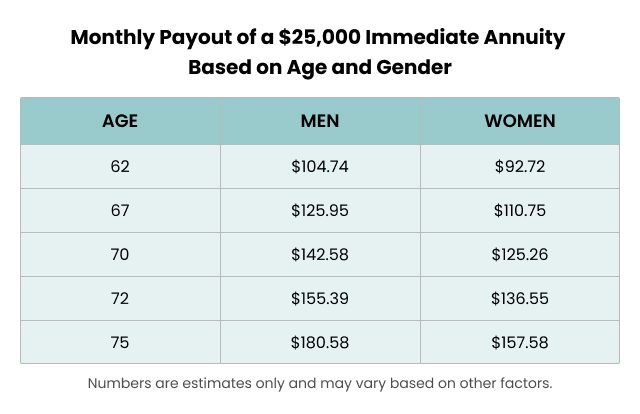

An annuity is an investment that provides a series of payments in exchange for an initial lump sum. Vanguard is a great choice for those looking for deferred variable annuities with low fees. Investment Calculator is a beautifully simple calculator to help you calculate the potential value of your retirement investments and visualize their growth.

Independent broker-dealers like Raymond James. Annuity distributors including large brokerage firms known as wirehouses such as Merrill Lynch and Morgan Stanley. FREE Quotes on all QLAC insurance companies.

Get Max RMD Income Guaranteed. 6 to 30 characters long. Read Vanguard Personal Review.

Which Is Better for Retirement. If you were to die the day after you take out a single-life annuity the insurer would swallow all. Advanced Series Trust AST Full Prospectus A 1 of 4 opens in new window Advanced Series Trust AST Full Prospectus B 2 of 4 opens in new window.

And telephone and internet banking services comprising online bill pay as well as acts as an agent for insurance and annuity products. With this calculator you can find several things. Compare mutual funds and ETFs.

Dollar-cost averaging calculator vanguard. Bitcoin IRAs can diversify your retirement portfolio and eliminate capital gains taxes. A tool in the Vanguard website for Vanguard clients that breaks down portfolio into asset classes.

Charles Schwab is well-known for its extensive lineup of Schwab index and mutual funds offering many no-load low-fee fund options with 100 minimum investment requirementsIt also offers more. An annuity is a contract between you and an insurance company. Find out how you are doing at your age based on your salary.

As an investor-owner you own the funds that own Vanguard. Get 247 customer support help when you place a homework help service order with us. ASCII characters only characters found on a standard US keyboard.

The payment that would deplete the fund in a. Save thousands on your IRA RMD taxes along with guaranteed lifetime income. Try our Intrinsic Value Calculator.

What Is an Annuity. Unless specified otherwise the Portfolio links below provide access to the summary prospectus statutory prospectus statement of additional information and the shareholder reports. Based on 4 retirement annuity.

Advanced Series Trust Prospectuses. Read Stash Invest Review. When taking withdrawals from an IRA before age 59½ you may have to pay ordinary income tax plus a 10 federal penalty tax.

Annuity rates are at record lows. Must contain at least 4 different symbols. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

It operates through a network of 16 full-service offices 2 limited-service offices and 1 residential mortgage loan production office. See main article for more information and caveatslimitations of the tool. For the 10-year period ended December 31 2021 7 of 7 Vanguard money market funds 67 of 86 Vanguard bond funds 21 of 24 Vanguard balanced funds and 128 of 183 Vanguard stock fundsfor a total of 223 of 300 Vanguard fundsoutperformed their Lipper peer group averages.

You can easily use this by adding your total assets. Variable percentage withdrawal VPW is a method which adapts portfolio withdrawal amounts to the retirees retirement horizon asset allocation and portfolio returns during retirementIt combines the best ideas of the constant-dollar constant-percentage and 1N withdrawal methods to allow the retiree to spend most of the portfolio using return-adjusted. Its a Self Invested Personal Pension so you have control over how you want your money to be invested.

This calculator shows what interest rate you need to earn to reach a retirement goal. Rowe Price which are considered some of the most competitive companies because they offer lower fees. At Vanguard that means you can choose from our full range of over 75 low-cost funds.

Only IRS approved RMD tax deferral investment until age 85. Our 401k calculator will help you figure out what your 401k will be worth at retirement.

Pension Calculator Pensions Calculator Words Data Charts

Joint And Survivor Annuity The Benefits And Disadvantages

How Does An Annuity Work Due

Own An Inherited Annuity Stretch Your Assets With A Low Cost Tax Efficient Option Kiplinger

Updating My Favorite Performance Chart For 2019 A Wealth Of Common Sense Investing Weekend Reading Stock Market

Variable Annuity What Are Variable Annuities How Do They Work

How Does An Annuity Work Due

How Much Money Do You Need To Start An Annuity

What Is An Inflation Protected Annuity And How Does It Work 2022

Why Buy An Annuity Top 4 Reasons To Purchase Annuities

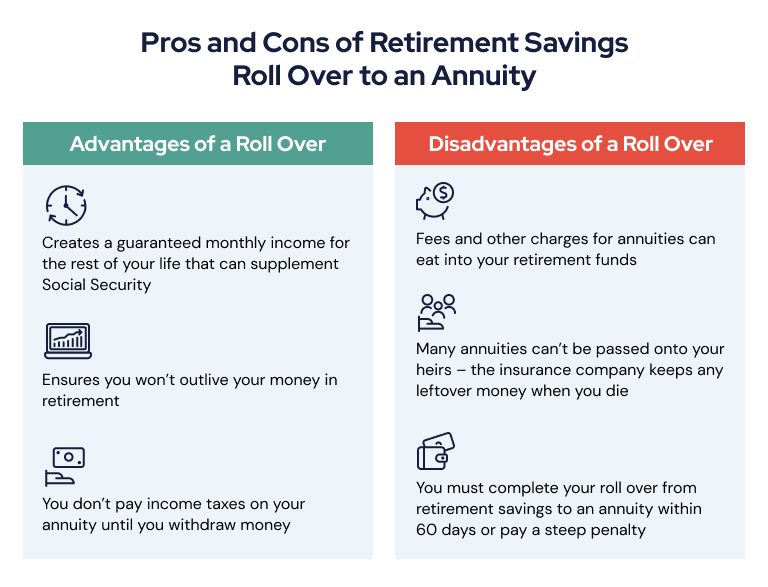

How To Roll Your Ira Or 401 K Into An Annuity

Vanguard What Else Should I Think About

How Much Does A 250 000 Annuity Pay The Annuity Expert

Best Fixed Annuity Rates Up To 4 80 September 17 2022

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

How Much Does A 500 000 Annuity Pay The Annuity Expert

Vanguard Annuity What You Need To Know The Motley Fool Annuity The Motley Fool Investing